This post may not age well. Let’s hope that is the case.

As of this writing, most smaller nonprofit organizations are still waiting to hear any official word on the Economic Injury Disaster Loan (EIDL) program applications and the Paycheck Protection Program (PPP) loan applicaitons. Each of these is up to 100% forgivable when used for paying staff (read all the details on the link), and could make a huge difference to keeping small nonprofits (under 500 employees) in business. A $10,000 advance in 3-5 business days could be huge. Payroll support for up to $10,000,000 for small employers would be huge.

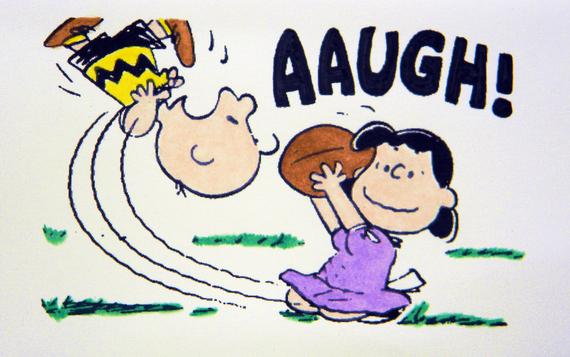

What if a program was promised with one set of criteria, but then the football was pulled-away?

Nonprofit organizations are being told to plan for this help in just a week for the EIDL advance. So keeping people on payroll knowing $10,000 would just be a few business days away makes sense. The PPP loans were not opened for nonprofits until April 3, but the criteria looked positive. “First come, first served” language was published, so many nonprofits spent lots of time getting applications ready, passing board resolutions, readying lots of personal information (banks can require that to open accounts, and this is technically a loan at the start). Lots of time, lots of running around.

But banks can process applications in any order they choose. First come, first served means first applications submitted to the SBA are first considered. Banks are apparently prioritizing their own customers, where they have a financial interest in keeping those people in business (and to be fair, where the applications are easier since they have accounts). Larger groups with bigger staff have the capacity to apply sooner than smaller nonprofits with fewer staff. In short, the chance of money still being available by the time they get considered are dwindling rapidly – or perhaps have already closed.

But the websites don’t note this. The sites linked above (as of this writing) encourage people to spending the time to apply, to keep people on payroll rather than furloughing or laying off people. But the anticipated help to make that payroll may already be gone. The football continues to be held out.

Charities need to make smart decisions about where to spend their time. Don’t apply for emergency grants when you clearly don’t meet criteria. Conversely, if the SBA is not able to actually process loans for small nonprofits because larger, SBA-banked businesses/nonprofits will use those resources first, they should stop encouraging charities to apply. They should be using the unemployment insurance program for their people, and not encouraging debt they can’t repay with promises that won’t be kept.